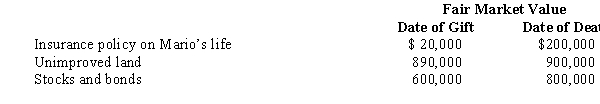

In 2006,Mario transferred several assets by gift to different persons.Mario dies in 2008.Information regarding the properties given is summarized below.

The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000.As to these transactions,Mario's gross estate must include:

Definitions:

Lawton IADL Instrument

An assessment tool used to measure an individual’s ability to perform instrumental activities of daily living, indicating their level of independence.

Self-Report

A method for gathering data where individuals provide information about themselves, often used in surveys and questionnaires.

Environmental Hazards

Refer to potentially harmful factors or conditions in the environment that can cause adverse health effects, including chemical, physical, and biological agents.

Grab Bars

Safety devices installed in bathrooms or other areas to provide support and stability, helping to prevent falls.

Q20: Pearl,Inc.,a tax-exempt organization,leases a building and machinery

Q26: When there's asymmetric information,who tends to have

Q37: Generally,an administrative expense attributable to municipal bond

Q71: Because of the estate tax deduction,a testamentary

Q102: The Eagleton Trust generated distributable net income

Q106: The Statements on Standards for Tax Services

Q121: What is the purpose of the unrelated

Q133: Net Corporation's sales office and manufacturing plant

Q138: At the time of his death,Norton was

Q148: A service engineer spends 30% of her