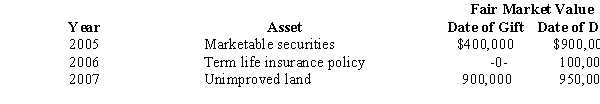

Prior to his death in 2008,Rex made the following gifts.

As a result of the 2007 transfer,Rex paid a gift tax of $70,000. As to these transactions,Rex's gross estate includes:

Definitions:

Output Effect

The impact on total production when a firm adjusts its output level in response to a change in price.

Interest Rates

The cost of borrowing money or the return on investment for savings and loans, influencing economic activity by affecting consumer spending and business investments.

Demand For Capital

refers to the desire for investment in physical goods, technology, or equipment that can be used to produce other goods or services.

Derived Demand

The demand for a good or service that arises from the demand for another good or service, such as the demand for steel being derived from the demand for cars.

Q7: The basic Treasury document regulating tax preparers

Q37: Mickey,a calendar year taxpayer,filed a return correctly

Q92: The IRS targets high-income individuals for a

Q93: The Gable Trust reports $20,000 business income

Q120: Norman Corporation owns and operates two manufacturing

Q126: Faye,a CPA,is preparing Judith's tax return.One item

Q133: Revocable trusts.

Q145: The Statements on Standards for Tax Services

Q179: For Federal estate and gift tax purposes,the

Q180: Kim,a resident and citizen of Korea,dies during