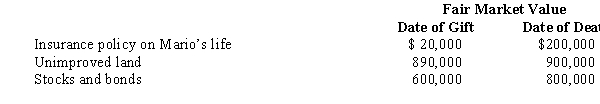

In 2006,Mario transferred several assets by gift to different persons.Mario dies in 2008.Information regarding the properties given is summarized below.

The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000.As to these transactions,Mario's gross estate must include:

Definitions:

Technology

Technology encompasses the tools, systems, and processes that are created and used to solve problems or improve efficiency, ranging from simple implements to complex machinery and information systems.

Human Resources

The department within an organization tasked with managing employee-related functions like hiring, training, and benefits.

Rigid

Characterized by inflexibility or the inability to adapt to new situations, often leading to inefficiency or failure in changing environments.

Q21: In a typical estate freeze involving family

Q24: In determining a corporation's taxable income for

Q33: How does a passive investment company reduce

Q75: Manfredo makes a donation of $50,000 to

Q94: Under the general rules of Subchapter J,whoever

Q100: P.L.86-272 _ (does/does not)create nexus when the

Q103: With respect to a selling expense incurred

Q106: Dough Company sold an asset on the

Q128: A Federal gift tax might be paid

Q172: Bernice dies and leaves property to her