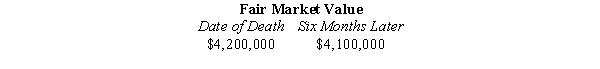

Art and Melinda have always lived in a community property state.At the time of Art's prior death,they held land that cost them $500,000 but was valued as follows.

Under Art's will,his half of the land passes to their daughter,Matilda.What income tax basis will Melinda and Matilda have in the land,if Art's estate:

a.Elects the alternate valuation date of § 2032?

b.Does not elect the alternate valuation date of § 2032?

Definitions:

Community Standard

Refers to the moral, ethical, or legal expectations that are generally held by a community or society.

Preserve Social Order

Efforts or measures taken to maintain societal norms and regulations, ensuring the smooth function and stability of a community or society.

Rational Consideration

The idea that decisions in contracts are made based on sound judgment and with a reasonable expectation of benefit or reward.

Driving Under Influence (DUI)

The criminal offense of operating a vehicle after consuming alcohol or other intoxicants, beyond legal limits.

Q1: The daily turnover in the foreign exchange

Q3: Paul dies and leaves his traditional IRA

Q29: In 2003,Otto dies leaving an after-tax estate

Q30: The Commissioner of the IRS is appointed

Q71: Which of the following is a typical

Q80: When the IRS issues a notice of

Q81: If the price level in Japan increases

Q144: The Gable Trust reports $20,000 business income

Q150: At the time of her death,Sally was

Q175: At the time of her death,Abigail held