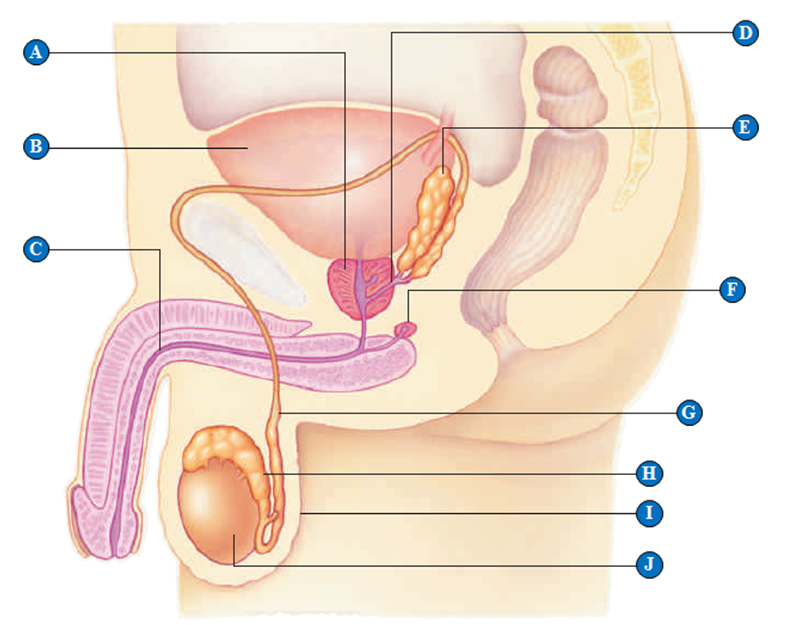

Which of the following part for:

-Scrotum

Definitions:

Deferred Tax Liability

A tax obligation due in the future for income that has been recognized in the financial statements before it is taxable by tax authorities.

Tax Depreciation

The depreciation expense deducted for tax purposes, allowing taxpayers to recover the cost of a property or asset used in a trade or business for income-producing purposes.

Accounting Depreciation

Represents the systematic allocation of the depreciable amount of an asset over its useful life, reflecting the wear and tear, obsolescence, or other declines in value as an expense in the income statement.

Company Tax Rate

The rate at which a corporation's income is taxed by the government.

Q18: Insects that lay eggs in or on

Q28: Pleural membrane

Q32: This blood component engulfs bacteria and cellular

Q39: In this type of competitive interaction,the competing

Q42: Gastrin<br>A)Made in the intestinal lining; removes amino

Q44: Name the anterior pituitary hormone with roles

Q48: The above figure of goslings (baby geese)following

Q52: Succession<br>A)Blending in and being hidden by the

Q59: A bear feeding on an adult salmon

Q81: Douching<br>A)Disorder in which uterine tissue grows outside