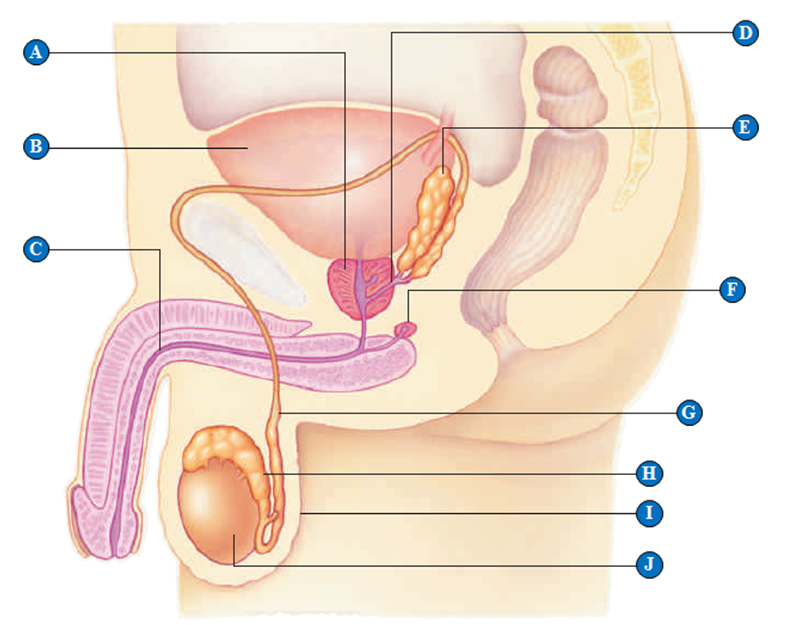

Which of the following part for:

-Testis

Definitions:

Unrelated Business Income

Income generated from activities that are not directly related to an organization's primary mission, of particular concern for nonprofits maintaining tax-exempt status.

Forms 990

The IRS forms required to be filed by nonprofit organizations in the United States, providing the public with financial information about the nonprofit's operations.

Sarbanes-Oxley Act

A United States federal law that sets new or expanded requirements for all U.S. public company boards, management, and public accounting firms.

Tax Cuts

Reductions in the amount of tax that individuals or corporations are required to pay to the government.

Q4: What substance required for aerobic metabolism is

Q7: cross-bridge is formed between thick and thin

Q7: Which of the following are long-lived lymphocytes

Q23: This is a factor that causes a

Q37: Oxygen is transported throughout the body by

Q43: Which of these is NOT a direct

Q45: Species richness is greatest at which latitude?

Q52: Intercostal muscles<br>A)Flexible windpipe reinforced with cartilage<br>B)Detect carbonic

Q65: The spinal cord runs through,and is protected

Q65: Chemical digestion of food is completed here.<br>A)Stomach<br>B)Gallbladder<br>C)Small