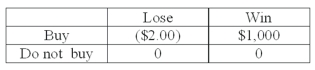

A person is trying to decide if they should buy a lottery ticket. The ticket costs $2.00. If the ticket is a winner, the prize would be $1,000. Knowing that winning $1,000 is not a certain outcome (state of nature) , the person finds that the probability of winning is 0.001. Based on this information, the following payoff table can be constructed:  What is the decision using a maximax or optimistic approach?

What is the decision using a maximax or optimistic approach?

Definitions:

Floatation Costs

The total costs associated with a company issuing new stocks or bonds, including underwriting, legal, registration, and other expenses.

Dividend Irrelevance Theory

A theory proposed by Modigliani and Miller that suggests dividend policies do not affect a company’s capital structure or stock price in a perfect market.

Dividend Policy

A company's approach to distributing profits back to its shareholders, whether through cash dividends or share repurchases.

Dividend Irrelevance Theory

A theory suggesting that the dividend policy of a company is irrelevant to its value or the cost of capital and investment decisions.

Q22: Personal justice is justice concerned with the

Q24: The first line of defense against accounting

Q39: Acceptance sampling and control charts may be

Q41: The trial judge is challenged to carefully

Q75: In acceptance sampling, if the number of

Q83: Knowing the seasonal pattern in the form

Q106: You have four different strategic business plans

Q126: Suppose your annual 2001 salary was $40,000

Q129: The Bureau of the Census reported that

Q136: The "in control" region of a control