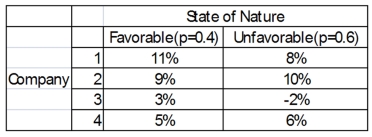

You have a decision to invest $10,000 in any of four different companies. You estimate the probabilities that the economy will be favorable or unfavorable, and you estimate the percent returns over the next year.  What is the expected value for Company 1?

What is the expected value for Company 1?

Definitions:

Photoreceptor Cells

Cells in the retina that convert light into electrical signals, enabling vision by transmitting these signals to the brain.

Ganglionic Layer

A layer of the retina that contains the cell bodies of ganglion cells and is a critical part of the visual pathway.

Choroid Layer

A layer of the eye between the retina and the sclera that contains blood vessels and provides oxygen and nutrients to the eye.

Pigment Cell Layer

A layer of cells that contain pigment, such as the melanin-containing cells found in the skin or the iris of the eye, which provide coloration and protection from UV light.

Q8: Write a short note on body language.

Q12: _ of indirect proof is generally limited

Q26: Which of the following is a difference

Q26: A new machine is set or calibrated

Q31: In criminal cases,sanctions generally involve compensation for

Q42: While calculating economic damages,application of a risk-free

Q48: A sampling plan states that if 20

Q68: A major distributor buys shoes from a

Q120: The take home pay of an employee

Q134: Product sales since 2001 are: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2537/.jpg"