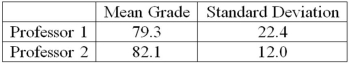

Two accounting professors decided to compare the variance of their grading procedures. To accomplish this, they each graded the same 10 exams, with the following results:  What is the alternate hypothesis?

What is the alternate hypothesis?

Definitions:

Mean-Variance Efficient Portfolio

An investment portfolio optimized for the highest expected return for a given level of risk, based on modern portfolio theory.

Covariances

A measure of how two securities move in relation to each other, indicating the degree to which their returns are interconnected.

Investments

The act of allocating resources, usually money, with the expectation of generating an income or profit.

Single Index Model

A simplified financial model that describes the return of a security as a linear function of the return of a single market index, plus some random noise.

Q2: If we wanted to see if tossing

Q14: An example of a hypothesis is: A

Q15: A large department store examined a sample

Q64: The mean annual incomes of certified welders

Q92: A multiple regression analysis showed the following

Q108: The mean weight of newborn infants at

Q109: A sum of squares divided by its

Q117: A sample of 50 is selected from

Q133: In ANOVA, the null hypothesis is:<br>A) <img

Q155: What does a significantly large chi-square statistic