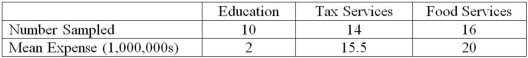

A random sample of 40 companies with assets over $10 million was surveyed and asked to indicate their industry and annual computer technology expense. The ANOVA comparing the average computer technology expense among three industries rejected the null hypothesis. The mean square error (MSE) was 195. The following table summarized the results:  Based on the comparison between the mean annual computer technology expense for companies in the education and tax services industries, _________________.

Based on the comparison between the mean annual computer technology expense for companies in the education and tax services industries, _________________.

Definitions:

Affordable Consumption Options

Economically accessible choices available to consumers for goods and services within their budget constraints.

Indifference Curves

A graph representing different bundles of goods between which a consumer is indifferent, showing preferences and trade-offs.

Substitution Effect

The change in consumption patterns due to a change in relative prices, leading consumers to substitute a product with a cheaper alternative.

Income Effect

The change in consumption resulting from a change in real income, typically due to a change in prices, that can increase or decrease purchasing power.

Q12: Which of the following statements about stepwise

Q26: The test statistic for a goodness-of-fit test

Q27: Thirty-six items are randomly selected from a

Q34: When testing for differences between treatment means,

Q39: The number of mean square errors summarized

Q49: If we are testing for the difference

Q54: The average cost of tuition and room

Q54: The mean of all the sample means

Q72: Consider a regression analysis, where the correlation

Q79: A financial planner wants to compare the