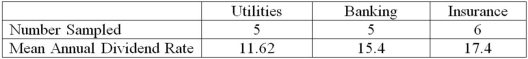

The annual dividend rates for a random sample of 16 companies in three different industries, utilities, banking, and insurance were recorded. The ANOVA comparing the mean annual dividend rate among three industries rejected the null hypothesis that the dividend rates were equal. The mean square error (MSE) was 3.36. The following table summarized the results:  Based on the comparison between the mean annual dividend rate for companies in utilities and banking, the 95% confidence interval shows an interval of 1.28 to 6.28 for the difference. This result indicates that _____________________.

Based on the comparison between the mean annual dividend rate for companies in utilities and banking, the 95% confidence interval shows an interval of 1.28 to 6.28 for the difference. This result indicates that _____________________.

Definitions:

Maintenance Costs

Expenses incurred to keep property, equipment, or machinery in efficient operating condition and repair.

Productive Asset

Assets that are used by a business to generate revenue, which can include physical property, equipment, and machinery, among other items.

Residual Value

The estimated amount that an asset is expected to realize upon the end of its useful life after all depreciation or amortization has been accounted for.

Market Value

The current price at which an asset or service can be bought or sold in the market.

Q5: If we are testing the difference between

Q8: When all the items in a population

Q25: Sampling is required when crash testing cars

Q45: A company wants to estimate next year's

Q53: A population has a known standard deviation

Q60: A manager at a local bank analyzed

Q60: A hypothesis regarding the weight of newborn

Q75: If we are testing for the difference

Q88: An interval estimate is a single value

Q126: Using the following information: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2537/.jpg" alt="Using