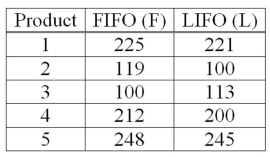

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the null hypothesis?

What is the null hypothesis?

Definitions:

Cranial Nerves

A set of twelve nerves that originate in the brain and provide motor and sensory functions primarily to the structures of the head and neck.

Spinal Cord

The spinal cord is a long, thin, tubular structure made up of nervous tissue, which extends from the medulla oblongata in the brainstem down the vertebral column to the lumbar region.

Diencephalon

A region of the brain located beneath the cerebrum that includes structures such as the thalamus and hypothalamus, involved in sensory and neural functions.

Hypothalamus

A region of the brain below the thalamus that coordinates both the autonomic nervous system and the activity of the pituitary, controlling body temperature, thirst, hunger, and other homeostatic systems.

Q34: Accounting procedures allow a business to evaluate

Q38: The annual commissions per salesperson employed by

Q41: In the least squares equation, Ŷ =

Q62: It has been hypothesized that overall academic

Q67: Explain the concept of a confidence interval

Q87: A manufacturer claims that less than 1%

Q90: When expressed as a percentage, what is

Q92: Six people have declared their intentions to

Q108: How many different samples of size 4

Q127: A survey of property owners' opinions about