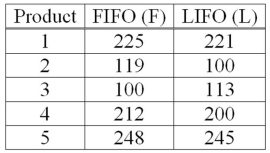

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the alternate hypothesis?

What is the alternate hypothesis?

Definitions:

Corporate Debt

Financial obligations owed by a corporation, typically arising from bonds or loans used to finance the company's operations.

LLC

A Limited Liability Company is a business structure in the United States that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.

Management Rights

The legal and contractual powers that empower an employer to control and direct their workforce and operations.

Capital Contributions

Investments made by owners or shareholders into a company or partnership, increasing the company's equity.

Q2: Consider independent simple random samples that are

Q4: To evaluate the assumption of linearity, a

Q16: In multiple regression analysis, a dummy variable

Q21: In the sampling distribution of the sample

Q37: A confidence interval can be determined for

Q46: How are residual plots drawn and used

Q62: A machine cuts steel to length for

Q70: The variance inflation factor can be used

Q70: When testing for a difference between the

Q107: All possible samples of size n are