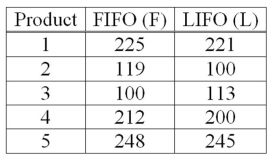

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  If you use the 5% level of significance, what is the critical t value?

If you use the 5% level of significance, what is the critical t value?

Definitions:

Price Discount

A reduction from the usual cost of an item or service, used as a strategy to increase customer purchases or reduce inventory.

Anticipation Inventory

Stocks held in anticipation of customer demand, allowing companies to meet consumer needs without delay.

Larger Quantities

Refers to the acquisition or production of goods or services in high volumes, typically achieving economies of scale.

Market Approach

A method used to value a business or asset based on the price at which similar companies or assets have been sold.

Q1: A committee that is studying employer-employee relations

Q15: A large department store examined a sample

Q15: Using the following regression analysis: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2537/.jpg"

Q19: A university has 1,000 computers available for

Q21: One of the major U.S. tire makers

Q25: Some normal probability distributions are positively skewed.

Q34: When a confidence interval for a population

Q35: In an ANOVA table for a multiple

Q66: A survey of an urban university (population

Q86: The population variation has little or no