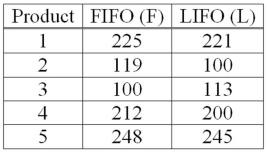

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the value of calculated t?

What is the value of calculated t?

Definitions:

Processing Costs

Expenses associated with the process of transforming raw materials into finished goods, often used in industries where products undergo many stages of production.

Sales and Direct Cost

The total revenue generated from goods and services minus the direct costs associated with producing those goods and services.

Activity-Based Costing

A method of costing that identifies the relationship between costs, activities, and products, and through this relationship, assigns indirect costs to products less arbitrarily than traditional methods.

Processing Costs

The expenses involved in handling, treating, or converting raw materials into finished products.

Q1: A committee that is studying employer-employee relations

Q4: When dependent samples are used to test

Q44: A population consists of the following four

Q49: If we are testing for the difference

Q58: We test for a hypothesized difference between

Q63: The standard error of the mean is

Q79: The tread life of tires mounted on

Q98: If the correlation coefficient between two variables,

Q105: Using the following regression analysis: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2537/.jpg"

Q127: A sales manager for an advertising agency