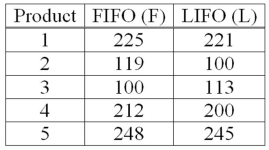

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

Definitions:

Diagnostic Assemblies

Systems or units assembled with the purpose of diagnosing or troubleshooting problems in larger machines or equipment.

Productive Work

Activities that directly contribute to producing goods or providing services that are valued by customers or the organization.

Hybrid Automobiles

Vehicles that use more than one form of onboard energy to achieve propulsion, typically combining an internal combustion engine with an electric motor.

Q29: Sampling from a population may be preferred

Q51: Assuming a normal population with a known

Q61: In multiple regression analysis, testing the global

Q73: Suppose we select every fifth invoice in

Q77: Assuming that the larger of two variances

Q85: It has been hypothesized that overall academic

Q86: What is the probability of making a

Q127: A group of statistics students decided to

Q135: The normal distribution can be used to

Q139: We are interested in knowing if the