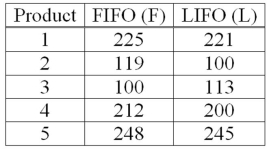

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  This example is what type of test?

This example is what type of test?

Definitions:

Standard Deviation

A measure of the dispersion or spread of a set of values, indicating how much the values differ from the average of the set.

Coefficient Of Correlation

A statistical measure that indicates the extent to which two variables fluctuate together. A value closer to 1 or -1 indicates a stronger relationship.

Decreases

To become smaller or less in size, amount, intensity, or degree.

Portfolio Returns

The gain or loss on an investment portfolio, measured over a specific period of time.

Q11: A population consists of 10 values. How

Q13: The null hypothesis for an ANOVA analysis

Q17: The finite population correction factor is applied

Q45: Which of the following is true regarding

Q46: How is a p-value related to the

Q48: The seasonal output of a new experimental

Q79: What is the null hypothesis to test

Q80: Approximately _% of the observations lies within

Q105: The level of significance is the probability

Q117: A sample of 50 is selected from