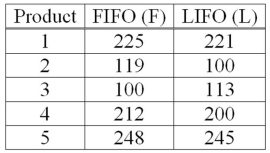

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the alternate hypothesis?

What is the alternate hypothesis?

Definitions:

Opportunity Cost

The cost of forgoing the next best alternative when making a decision, representing the benefits an individual, investor, or business misses out on.

Scarce Goods

Products or resources that are limited in availability and cannot meet all the demands of consumers.

Comparative Advantage

The ability of a country or firm to produce a specific good or service at a lower opportunity cost than its competitors.

Opportunity Cost

The cost of forgoing the next best alternative when making a decision or choice.

Q10: The estimate of the population proportion is

Q31: In multiple regression, the multiple R<sup>2</sup> measures

Q32: A preliminary study of hourly wages paid

Q36: A sample of 25 is selected from

Q70: When a second source of variance is

Q80: What is another name for the alternate

Q94: Two accounting professors decided to compare the

Q103: The regression equation is Ŷ = 29.29

Q109: The mean amount spent by a family

Q121: To compare the effect of weather on