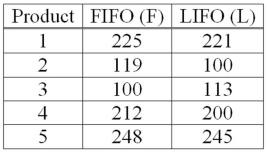

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the value of calculated t?

What is the value of calculated t?

Definitions:

Dorsal Surface

The dorsal surface refers to the back side of an organism or the upper side of body parts that lie horizontally.

Ventral Surface

The front or abdomen side of the body in animals; opposite of dorsal.

Midline

An imaginary line that divides the body into equal right and left halves.

Underlying Fascia

The connective tissue located beneath the skin and muscles, which encloses and separates muscle layers, providing structural support and facilitating movement.

Q16: A z-value measures the distance between an

Q17: What is the range of values for

Q21: The minimum and maximum of values of

Q26: Which symbol represents a test statistic used

Q44: A "continuity correction factor" is used to

Q54: The mean of all the sample means

Q55: When deciding on the number of observations

Q68: The standard error of the mean measures

Q77: A population consists of the following five

Q95: A company wants to study the effect