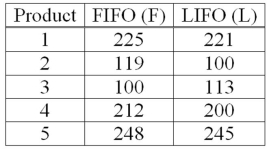

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  This example is what type of test?

This example is what type of test?

Definitions:

Simulation Analysis

A technique used to predict the outcome of a project or investment by running multiple simulations with various sets of assumptions.

Capital Rationing

The process of restricting the amount of capital available for investment in new projects by a company due to budget constraints.

Managerial Options

Choices or decisions available to managers that allow them to steer the company in different strategic directions.

Strategic Planning

A systematic process for envisioning a desired future and translating this vision into broadly defined goals and a sequence of steps to achieve them.

Q8: The values of a and b in

Q19: In a graph of the uniform distribution,

Q43: The best example of a null hypothesis

Q51: Assuming a normal population with a known

Q66: When dependent samples are used to test

Q105: What is the area under the normal

Q109: The mean amount spent by a family

Q125: A binomial distribution has 100 trials (n

Q133: In ANOVA, the null hypothesis is:<br>A) <img

Q177: Six people have declared their intentions to