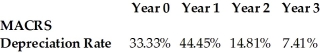

A machine is purchased for $575,000 and is used through the end of Year 2. The machine will be depreciated using the 3-Year MACRS schedule. At the end of Year 2, the machine is sold for $75,000. What is the after-tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal tax rate is 35%?

A machine is purchased for $575,000 and is used through the end of Year 2. The machine will be depreciated using the 3-Year MACRS schedule. At the end of Year 2, the machine is sold for $75,000. What is the after-tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal tax rate is 35%?

Definitions:

Left Tailed

Refers to a type of hypothesis test where the area of interest, or region of rejection, is located in the left tail of the distribution.

Test-Statistic

A quantity derived from sample data used in a hypothesis test to make a decision about the population parameter.

Right Tailed

Pertaining to a type of hypothesis test where the area of interest is in the right tail of the distribution, typically testing for values greater than a certain number.

Test-Statistic

A value calculated from sample data during hypothesis testing used to determine whether to reject the null hypothesis.

Q7: The Sisyphean Company has a bond outstanding

Q12: NoGrowth Industries presently pays an annual dividend

Q23: A large oil company is studying the

Q36: Refer to the following distribution of commissions:

Q46: Martin wants to provide money in his

Q75: An orcharder spends $110,000 to plant pomegranate

Q82: Ford Motor Company is considering launching a

Q82: Assume your current mortgage payment is $900

Q94: In the following table, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2537/.jpg" alt="In

Q109: A small business repairs its store. The