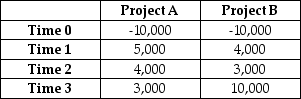

If WiseGuy Inc is choosing one of the above mutually exclusive projects (Project A or Project B) , given a discount rate of 7%, which should the company choose?

If WiseGuy Inc is choosing one of the above mutually exclusive projects (Project A or Project B) , given a discount rate of 7%, which should the company choose?

Definitions:

Exemption

A provision that reduces or eliminates a taxpayer's obligation to pay tax, typically based on certain conditions or qualifications.

Tax Bill

A statement from a government authority specifying the amount of tax owed by an individual or entity.

Proration

The allocation or division of financial amounts based on a proportionate distribution, often applied in billing, refunds, or dividends.

Taxable Year

The one-year period that is used for calculating taxes, which can be either a calendar year or a fiscal year.

Q2: Which of the following is/are TRUE?<br>I. The

Q26: Luther Industries has a dividend yield of

Q37: If your new strip mall will have

Q52: Categorizing students as freshmen, sophomores, juniors, and

Q65: What is the yield to maturity of

Q78: A sample of single persons receiving Social

Q79: The Equal Employment Opportunity Act requires employers

Q92: If an arbitrage opportunity exists, an investor

Q97: What is the present value (PV)of $100,000

Q112: The relative frequency for a class represents