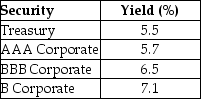

Consider the following yields to maturity on various one-year, zero-coupon securities:  The price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating is closest to ________.

The price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating is closest to ________.

Definitions:

Q14: In reality market imperfections exist that can

Q36: Internal rate of return (IRR)can reliably be

Q45: The Sisyphean Company's common stock is currently

Q61: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2789/.jpg" alt=" Refer to the

Q68: Elinore is asked to invest $5100 in

Q87: If available, should MACRS be preferred to

Q87: The yield curve is typically _.<br>A)downward sloping<br>B)upward

Q96: An investor purchases a 30-year, zero-coupon bond

Q99: The cash flow effect from a change

Q116: How do you apply the Net Present