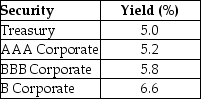

Consider the following yields to maturity on various one-year, zero-coupon securities:  The credit spread of the BBB corporate bond is closest to ________.

The credit spread of the BBB corporate bond is closest to ________.

Definitions:

Stroke

A medical condition characterized by the sudden death of brain cells due to lack of oxygen, caused by blockage or rupture of an artery to the brain.

Left-Side Weakness

A condition characterized by a reduction in muscle strength on the left side of the body, often resulting from neurological damage.

Multidisciplinary Team

A group of professionals from different disciplines working together towards a common goal, especially in healthcare settings.

Initial Planning

The first stage of setting goals and designing strategies to achieve desired outcomes in any project or treatment plan.

Q15: The following frequency distribution shows the distribution

Q18: Multinational firms often use currency forward contracts

Q22: A sample is a portion or part

Q26: Farmville Industries is a major agricultural firm

Q26: Consider the following equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2789/.jpg" alt="Consider

Q30: Which of the following statements is FALSE?<br>A)Long-term

Q37: Which of the following was not a

Q38: Consider a zero-coupon bond with a $1000

Q62: Which of the following formulas is INCORRECT?<br>A)g

Q101: Which of the following statements regarding arbitrage