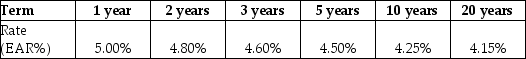

Suppose the term structure of interest rates is shown below:  The net present value (NPV) of an investment that costs $4320 and pays $1600 certain at the end of one, three, and five years is closest to ________.

The net present value (NPV) of an investment that costs $4320 and pays $1600 certain at the end of one, three, and five years is closest to ________.

Definitions:

Blinding

A research design technique where one or more parties in an experiment are unaware of the treatment assignments to prevent bias.

Experimental Unit

The smallest division of the experimental material such that any two units are independent and can be assigned to different treatments.

Cage

A structure of bars or wires in which animals or birds are confined.

Confounding Variable

A variable outside of the researcher's control that can affect the results of a study, potentially leading to misleading conclusions.

Q10: Market forces determine interest rates based ultimately

Q18: A mining company is offering to trade

Q23: How can the financial calculator be used

Q48: Two years ago you purchased a new

Q57: Which of the following statements regarding bonds

Q74: Jeff has the opportunity to receive lump-sum

Q77: Cameron Industries is purchasing a new chemical

Q93: Under what situation can a zero-coupon bond

Q96: An investor purchases a 30-year, zero-coupon bond

Q101: A small foundry agrees to pay $220,000