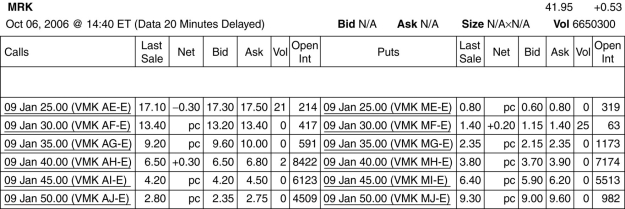

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-Assume you want to buy one options contract that with an exercise price closest to being at-the-money and that expires January 2009. The current price that you would have to pay for such a contract is ________.

Definitions:

Rectangular Hyperbola

A curve representing a relationship between two variables wherein the product of the two variables is constant, commonly used in economics to describe certain elasticities.

Price Elasticity

A measure of the responsiveness of the quantity demanded or supplied of a good to a change in its price, indicating how changes in price affect consumption or production.

Slope

In mathematics, the measure of the steepness or angle of a line, defined as the ratio between the rise and the run between two points on the line.

Rectangular Hyperbola

A type of curve, defined as the graph of an equation of the form xy = c, where c is a constant, representing certain economic relationships.

Q2: What is floating rate?

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2789/.jpg" alt=" The above diagram

Q21: If your firm is uninsured, the NPV

Q22: What are some of the disadvantages of

Q30: Compute the value of a firm with

Q35: Assuming that Ideko has an EBITDA multiple

Q39: What are European options?

Q40: Which of the following best describes short-term

Q69: When the exercise price of an option

Q73: A firm offers its customers 3/5 net