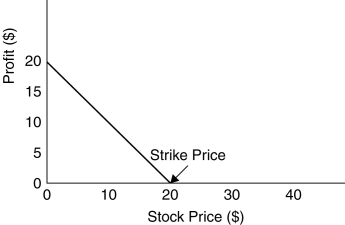

Use the figure for the question below.

-You have shorted a call option on WSJ stock with a strike price of $50. The option will expire in exactly six months. If the stock is trading at $60 in three months, what will you owe for each share in the contract?

Definitions:

Withholding Amount

The portion of an employee's wages deducted by the employer and paid directly to the government as partial payment of income tax.

Taxable Payment

Any payment subject to tax by the relevant authorities, including wages, salaries, bonuses, and other income streams.

Taxpayer

A person or organization required to make tax payments to governmental authorities at the federal, state, or local level.

Standard Deduction

A fixed amount that taxpayers can subtract from their income before income tax is applied, reducing their taxable income.

Q3: The risk that the firm will not

Q4: A firm should choose to borrow using

Q27: The present value (PV)of the £5 million

Q38: Suppose you purchase a call option for

Q42: Evertz Metals buys and stockpiles dolomite to

Q42: Which of the following statements is FALSE?<br>A)The

Q71: The amount of net working capital for

Q82: Anyone who purchases the stock on or

Q101: A firm wants to hedge a potential

Q105: Which of the following statements is FALSE?<br>A)Differential