Use the table for the question(s) below.

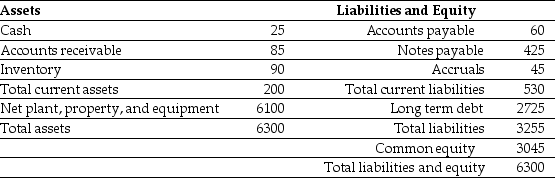

Luther Industries had sales of $980 million and a cost of goods sold of $560 million in 2006.A simplified balance sheet for the firm appears below:

Luther Industries

Balance Sheet

As of December 31,2006

(millions of dollars)

-Luther's Inventory days is closest to:

Definitions:

Breached Contract

Occurs when one party to a contract fails to fulfill its legal obligations as specified in the agreement, thereby violating the contract.

Private Sale

A transaction of goods or property conducted directly between individuals without the involvement of an intermediary or public auction.

Reasonable Notification

A requirement to give timely and clear information or warnings in various legal and regulatory contexts, ensuring that parties involved are properly informed.

Unique Goods

Items that are distinct in their characteristics, often irreplaceable, and cannot be substituted easily due to their rarity or specific traits.

Q4: Which of the following statements is FALSE?<br>A)If

Q16: Which of the following statements is FALSE?<br>A)All

Q17: The share price falls when a dividend

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2789/.jpg" alt=" Consider the above

Q22: ToysToys Corporation wants to borrow $500,000 for

Q24: Which of the following is the term

Q27: A firm has interest expense of $3,500

Q59: Refer to the income statement above. Luther's

Q70: What is the implied assumption in percent

Q78: Which of the following is a firm's