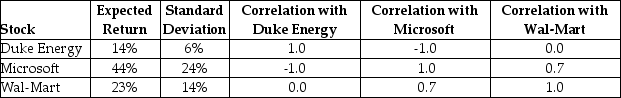

Consider the following expected returns, volatilities, and correlations:  The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

Definitions:

Indirect Method

A way of calculating cash flows in the cash flow statement, where net income is adjusted for changes in non-cash items and working capital.

Net Income

The total profit of a company after all expenses and taxes have been deducted from total revenue.

Sale Of Equipment

The process of disposing of fixed assets, such as machinery, for cash or other compensation.

Operating Activities

These are the core activities that generate revenue and involve expenses for a company, including sales and service provision.

Q4: When dealing with international capital budgeting projects,

Q12: You founded your own firm three years

Q15: Which of the following statements is FALSE?<br>A)Global

Q17: Aerelon Airways, a commercial airline, suffers a

Q24: Which of the following statements is FALSE?<br>A)By

Q36: You observe that AT&T stock and the

Q40: Suppose you invested $100 in the Ishares

Q46: Which of the following is an activity

Q80: A linear regression was done to estimate

Q104: The financial manager should _.<br>A)try to maximize