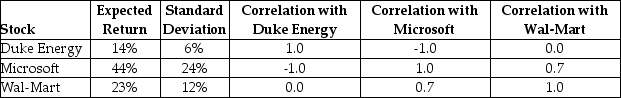

Consider the following expected returns, volatilities, and correlations:  The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to ________.

The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to ________.

Definitions:

Demonstration Approach

A sales technique where the product or service is presented in action, showcasing its benefits and functionalities directly to potential customers.

Memorized Sales

A sales technique involving the rote recitation of a standardized pitch or presentation to potential customers.

Questions

Inquiries made to gather information, clarify details, or provoke thought.

Statements

Formal or written articulations of facts, opinions, or courses of action.

Q5: The only proper way to estimate the

Q6: A company issues a callable (at par)five-year,

Q23: Terrorism, cyber attacks, and the anti-globalization movement

Q25: What are some of the advantages of

Q31: Which of the following statements is FALSE?<br>A)A

Q31: Chambers Industries has a market capitalization of

Q36: What are blocked funds? List and explain

Q39: The Foreign Credit Insurance Association is a

Q99: The average annual return for the S&P

Q109: MM Proposition I states that in a