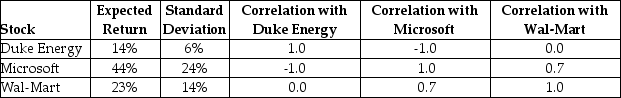

Consider the following expected returns, volatilities, and correlations:  The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

Definitions:

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Prepaid Insurance

An asset account on the balance sheet representing insurance paid in advance that provides coverage over future periods.

Net Income

The total profit of a company after all expenses, taxes, and costs have been subtracted from total revenue.

Accounts Receivable

Money owed to a business by its clients or customers for goods or services provided on credit.

Q10: How does the interest paid by a

Q11: Which of the following statements is FALSE?<br>A)Investors

Q19: Suppose you invested $59 in the Ishares

Q26: In an inflationary economy, demand for credit

Q30: A stock market comprises 4600 shares of

Q41: Suppose you invest $22,500 by purchasing 200

Q60: What is the term for the applicable

Q68: Consider the following realized annual returns: <img

Q88: Your estimate of the market risk premium

Q97: Which of the following is an advantage