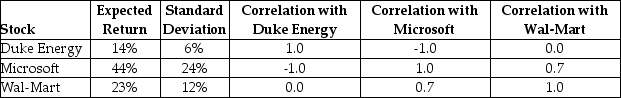

Consider the following expected returns, volatilities, and correlations:  The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to ________.

The volatility of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to ________.

Definitions:

Axle Windup

A term used in automotive mechanics referring to the torsional stress and deformation experienced by vehicle axles during acceleration or under heavy loads.

Equalizing-beam

A suspension component designed to evenly distribute load and shock across multiple axles for smoother vehicle operation.

Torque Rods

Longitudinal rods in truck and bus suspension systems that help manage the alignment of the axle, prevent excessive movement, and assist in absorbing road shock.

Centerbolts

Fasteners used to secure leaf springs in a suspension system, aligning the springs with the axle.

Q3: Big Box retailing has a market capitalization

Q8: An all-equity firm had a dividend expense

Q11: A portfolio of stocks can achieve diversification

Q26: Parafoil Avionics sells 50 million shares of

Q47: Why in general do financial managers make

Q48: The L in OLI refers to an

Q48: Assume that MM's perfect capital markets conditions

Q72: Which of the following would be most

Q74: Assume Time Warner shares have a market

Q98: As we increase the number of stocks