Use the table for the question(s) below.

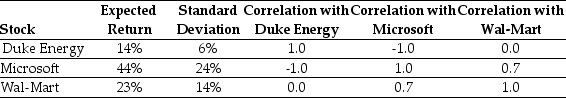

Consider the following expected returns, volatilities, and correlations:

-Which of the following combinations of two stocks would give you the biggest reduction in risk?

Definitions:

E-portfolio

An electronic collection of evidence that shows a person's learning journey over time, often including reflections and achievements.

Social Media Résumé

A Social Media Résumé is a digital summary of a person's skills, experience, and accomplishments presented on social media platforms to enhance job prospects and professional networking.

Multimedia Résumé

A résumé incorporating various formats such as video, images, and text to showcase an individual's skills and experience.

Active Statements

Sentences where the subject performs the action stated by the verb, emphasizing the action and making the writing clearer and more direct.

Q13: A straight bill of lading is most

Q13: On August 19, 2004 Google IPO offered

Q17: The _ is the instrument normally used

Q18: Governance risk due to goal conflict between

Q26: Refer to Table 20.1. How much in

Q35: The risk premium of a security is

Q40: Which of the following statements is FALSE?<br>A)If

Q41: When a callable bond sells at a

Q67: Put the following steps of the financial

Q81: When investing for a long term, investors