Use the table for the question(s) below.

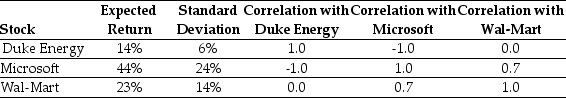

Consider the following expected returns, volatilities, and correlations:

-What is the lowest risk possible by selecting two stocks that are perfectly negatively correlated?

Definitions:

Transitional Expression

Words or phrases used to link sentences and paragraphs smoothly, guiding the reader through the text.

Social Class

A societal split determined by economic and social rankings.

Economic Class

A categorization based on the economic status of individuals or groups, often determined by income, wealth, and occupation.

Royal Woman

A female member of a royal family, often signifying someone of noble rank or birth within a monarchy.

Q10: How does the interest paid by a

Q23: In a typical international trade transaction, the

Q42: Which of the following investments had the

Q45: Based on the information shown above, how

Q45: What are some of the disadvantages of

Q59: Stock markets provide liquidity for a firm's

Q59: Which of the following best describes a

Q88: In terms of public offerings of bonds,

Q92: Which of the following will have the

Q106: Assume preferred stock of Ford Motors pays