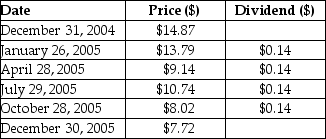

Consider the following price and dividend data for Quicksilver Inc.:  Assume that you purchased Quicksilver's stock at the closing price on December 31, 2004 and sold it at the closing price on December 30, 2005. Your realized annual return for the year 2005 is closest to ________.

Assume that you purchased Quicksilver's stock at the closing price on December 31, 2004 and sold it at the closing price on December 30, 2005. Your realized annual return for the year 2005 is closest to ________.

Definitions:

Cognitive School

The cognitive school of thought in psychology focuses on the study of mental processes including perception, memory, judgment, and reasoning.

Humanistic School

A psychological perspective that emphasizes individual potential for growth and the role of unique perceptions in guiding behavior and mental processes.

Joan Of Arc

A French heroine and military leader during the Lancastrian phase of the Hundred Years' War, who was canonized as a Roman Catholic saint.

Clinical Psychologists

Professionals specialized in diagnosing and treating mental, emotional, and behavioral disorders through psychological techniques and assessments.

Q10: When determining a firm's weighted average cost

Q19: The proper order of events for the

Q26: Refer to Table 20.1. How much in

Q28: A company issues a callable (at par)20-year,

Q33: The systematic risk (beta)of a portfolio is

Q34: How is a corporation different from most

Q36: Refer to Table 20.1. If MetroCity set

Q79: Financial managers must determine their firm's overall

Q89: If asset A's return is exactly two

Q104: A portfolio has 45% of its value