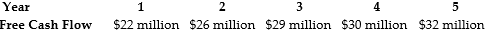

General Industries is expected to generate the above free cash flows over the next five years, after which free cash flows are expected to grow at a rate of 5% per year. If the weighted average cost of capital is 9% and General Industries has cash of $15 million, debt of $45 million, and 80 million shares outstanding, what is General Industries' expected current share price?

General Industries is expected to generate the above free cash flows over the next five years, after which free cash flows are expected to grow at a rate of 5% per year. If the weighted average cost of capital is 9% and General Industries has cash of $15 million, debt of $45 million, and 80 million shares outstanding, what is General Industries' expected current share price?

Definitions:

Q24: Which of the following is NOT a

Q31: The expected return is usually _ the

Q32: ADRs are a popular investment tool for

Q41: When a callable bond sells at a

Q59: What care, if any, should be taken

Q76: Stocks tend to move together if they

Q94: Stocks with high returns are expected to

Q95: Consider an economy with two types of

Q97: An all-equity firm had a dividend expense

Q100: For an unlevered firm, the cost of