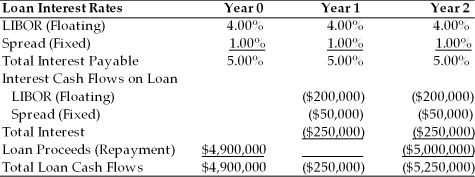

TABLE 9.1

Use the information for Polaris Corporation to answer following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 9.1. If the LIBOR rate falls to 3.00% after the first year what will be the all-in-cost (i.e. the internal rate of return) for Polaris for the entire loan?

Definitions:

Public Policy

Principles and standards considered by the government in making decisions that affect the public.

Voidable Contracts

Agreements that may be legally rejected or enforced by one or more parties, often due to elements like misrepresentation or lack of capacity.

Stare Decisis

“Standing by the decision” a principle stating that rulings made in higher courts are binding precedent for lower courts.

Watered Stock

Stock that is issued to individuals below its fair market value.

Q2: The authors highlight a strong theoretical argument

Q5: Joint ventures are a more common FDI

Q5: The time value is asymmetric in value

Q23: For the situations described below, explain whether

Q24: _ exposure measures the change in the

Q25: With licensing the _ is likely to

Q27: Refer to Instruction 11.2. If OTI chooses

Q33: Days working capital is equal to<br>A)days payables

Q36: Foreign stock markets are frequently characterized by

Q38: An alternative strategy to engaging in bribery