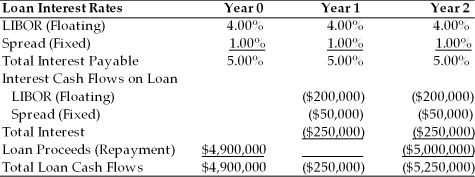

TABLE 9.1

Use the information for Polaris Corporation to answer following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 9.1. What is the all-in-cost (i.e., the internal rate of return) of the Polaris loan including the LIBOR rate, fixed spread and upfront fee?

Definitions:

Q1: Typically, a firm in its domestic stage

Q1: A forward contract to deliver British pounds

Q4: Level I ADRs trade primarily<br>A)on the New

Q12: Not all firms have the same optimal

Q15: Covered interest arbitrage moves the market _

Q19: Refer to Instruction 19.1. What is the

Q22: Expected changes in foreign exchange rates should

Q32: An interbank-traded contract to buy or sell

Q47: Which of the following is probably NOT

Q49: What information does the balance sheet provide