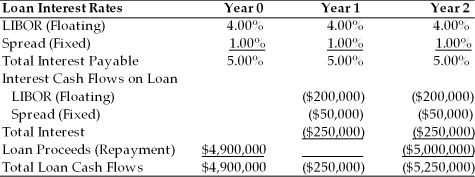

TABLE 9.1

Use the information for Polaris Corporation to answer following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 9.1. Polaris could have locked in the future interest rate payments by using

Definitions:

Stakeholders

Individuals or groups that have an interest in any decision or activity of an organization.

Contribute

To give or supply in common with others, adding to a greater whole.

Rewards

Benefits, compensation, or recognition given in response to someone’s behavior, effort, or achievement as a means of encouragement.

Incentives

Rewards or motivators provided to encourage specific actions or behaviors in individuals or groups.

Q2: Regime structures like the gold standard required

Q5: ADRs that are created at the request

Q17: Which of the following is NOT a

Q21: Of the following, which was NOT mentioned

Q22: Relative to the efficient frontier of risky

Q29: A _ resembles a back-to-back loan except

Q31: For firms to raise capital in international

Q32: The authors describe the multinational phase of

Q40: Exchange rate pass-through may be defined as<br>A)the

Q45: Compare and contrast foreign currency options and