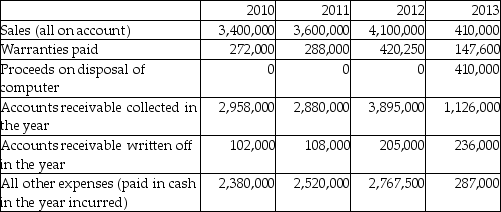

Xavier Computer Limited was started in early 2010 and continued to operate until early 2013, when it was wound up due to disputes between the two principal shareholders. When it started, the company used the following accounting policies:

1. Use 50% declining-balance depreciation for the firm's only asset, a computer which cost $1,100,000 and has an estimated useful life of four years.

2. Estimate warranty expense as 10% of sales.

3. The year-end allowance for doubtful accounts should be 40% of gross accounts receivable.

Derive net income for 2010 to 2012. For the year-end balance for 2013, assume accounts receivable, allowance for doubtful accounts, and the warranty accrual are $0, as the firm wound itself up during the year and all timing differences have been resolved.

Definitions:

Full Time

Employment status in which an individual works a minimum number of hours defined by their employer, typically at least 35 to 40 hours per week.

Business Profits

The financial gain made by a business, which is the excess of revenues over expenses.

Partners

Individuals or entities that collaborate in a business venture, sharing both the risks and rewards associated with the business.

Income

Income is the money an individual or business receives in exchange for providing labor, producing goods, or investing capital.

Q4: Which of the following is NOT another

Q5: Which statement is correct about recording an

Q25: Which statement best explains "moral hazard"?<br>A)The term

Q33: Anaconda Copper Inc. created a subsidiary in

Q60: Based on the note disclosure provided below

Q80: Why is determining the "cut-off" point critical

Q84: Maximum Inc. reported credit sales of $880,000,

Q106: What journal entry is required after the

Q114: Which statement best explains the FIFO cost

Q139: JP Corporation had net income of $1,000,000