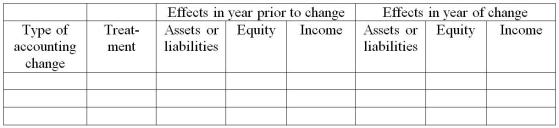

For each of the following scenarios, determine the effects (if any)of the accounting change (correction of error, change in accounting policy, or change in estimate)on the relevant asset or liability, equity, and comprehensive income in the year of change and the prior year. Use the following table for your response.  A. Company A increases the allowance for doubtful accounts (ADA). Using the old estimate, ADA would have been $71,000. The new estimate is $74,000.

A. Company A increases the allowance for doubtful accounts (ADA). Using the old estimate, ADA would have been $71,000. The new estimate is $74,000.

B. Company B omitted to record an invoice for a $7,000 sale made on credit at the end of the previous year and incorrectly recorded the sale in the current year. The related inventory sold has been accounted for.

C. Company C changes its revenue recognition policy to a more conservative one. The result is a decrease in prior year revenue of $4,200 and a decrease in current-year revenue of $6,300 relative to the amounts under the old policy.

Definitions:

Free Cash Flow

The amount of cash a company generates after accounting for capital expenditures, indicating the financial health and liquidity of a company.

Operations

The day-to-day activities necessary for a business to function, including production, sales, and administration.

PP&E

Property, Plant, and Equipment - tangible long-lived assets used in the normal course of business to produce goods and services.

Sale Of Land

This transaction involves the disposal of land owned by an entity, which can affect the financial statements through gains or losses.

Q11: Micelle Inc. reported credit sales of $600,000

Q14: Mortgage loans in the U.S. are classified

Q15: Which statement is correct about joint arrangements?<br>A)IFRS

Q16: When discussing the structure of corporate governance,

Q22: A foreign exchange _ is the price

Q32: Dividend yield is the change in the

Q37: Which statement is not correct about "associates"?<br>A)Holding

Q47: Which of the following is NOT likely

Q49: What information does the balance sheet provide

Q123: Outdoor Devices Inc. manufactures sport hunting equipment.