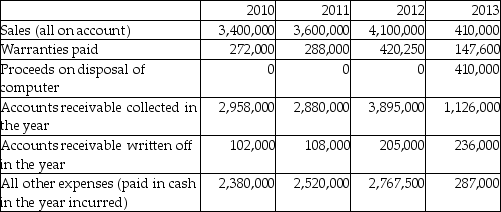

Xavier Computer Limited was started in early 2010 and continued to operate until early 2013, when it was wound up due to disputes between the two principal shareholders. When it started, the company used the following accounting policies:

1. Use 50% declining-balance depreciation for the firm's only asset, a computer which cost $1,100,000 and has an estimated useful life of four years.

2. Estimate warranty expense as 10% of sales.

3. The year-end allowance for doubtful accounts should be 40% of gross accounts receivable.

Derive net income for 2010 to 2012. For the year-end balance for 2013, assume accounts receivable, allowance for doubtful accounts, and the warranty accrual are $0, as the firm wound itself up during the year and all timing differences have been resolved.

Definitions:

Marginal Cost

The price of making one more unit of a product or service.

Average Product

The output per unit of input, such as labor or machinery, typically used in the context of analyzing production efficiency.

Marginal Cost

The increase in total cost that results from producing one additional unit of a good or service.

Total Cost

The total economic cost of production, including both fixed and variable costs.

Q2: If your company were to import and

Q8: Using the data provided below, determine whether

Q9: Which statement is not correct about expenses

Q9: Counterparty risk is greater for exchange-traded derivatives

Q34: Which of the following accurately describes the

Q37: Today, the United States has been ejected

Q42: Using the following cost information regarding finished

Q47: Which statement is not correct?<br>A)Factoring with recourse

Q94: Which accounting method is permitted under ASPE

Q133: Which method cannot be used in Canada