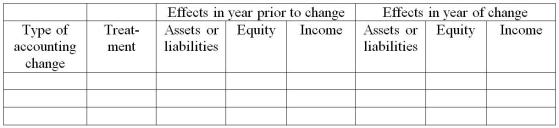

For each of the following scenarios, determine the effects (if any)of the accounting change (correction of error, change in accounting policy, or change in estimate)on the relevant asset or liability, equity, and comprehensive income in the year of change and the prior year. Use the following table for your response.  A. Company A increases the allowance for doubtful accounts (ADA). Using the old estimate, ADA would have been $71,000. The new estimate is $74,000.

A. Company A increases the allowance for doubtful accounts (ADA). Using the old estimate, ADA would have been $71,000. The new estimate is $74,000.

B. Company B omitted to record an invoice for a $7,000 sale made on credit at the end of the previous year and incorrectly recorded the sale in the current year. The related inventory sold has been accounted for.

C. Company C changes its revenue recognition policy to a more conservative one. The result is a decrease in prior year revenue of $4,200 and a decrease in current-year revenue of $6,300 relative to the amounts under the old policy.

Definitions:

Variable Factory Overhead

Costs that fluctuate with production volume, such as utilities and materials used in the manufacturing process.

Controllable Variance

The difference between actual expenses and budgeted expenses that management has the power to influence or control.

Factory Overhead

All indirect costs associated with manufacturing, such as utilities, maintenance, and salaries of non-direct labor, which are not directly attributed to the production of goods.

Variable Factory Overhead

Costs in the manufacturing process that fluctuate with production volume, such as materials and labor directly involved in production.

Q6: During the past year, Easy Supplies Ltd's

Q14: Discuss two ways in which a bank

Q18: Significant amounts of United States Treasury issues

Q28: The following is an example of an

Q39: A currency board exists when a country's

Q43: Empirical tests prove that PPP is an

Q46: According to the Big Mac Index, the

Q46: Marvelos Inc. reported credit sales of $1,000,000

Q60: Which statement is correct?<br>A)Factoring without recourse creates

Q96: WestCoast Co. started a contract in June