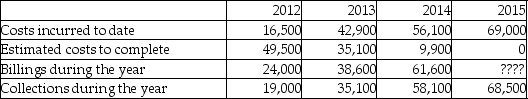

Creation Construction Company (CCC)has contracted to build an office building for Property Corp. The construction started on January 1, 2012, and the project was completed on July 1, 2015. The contract price was $70 million. Due to uncertainties in the construction process, the two parties to the project agreed to a risk-sharing arrangement whereby Property Corp. covers 50% of all cost overruns in excess of the originally estimated cost of $65 million (e.g., if estimated total costs are $69 million, then CCC would receive an additional $2 million for the contract). The following data relate to the construction period.

Required:

Required:

Calculate the estimated gross profit (loss)for 2012, 2013, 2014, and 2015, assuming that the percentage of completion method is used.

Definitions:

Proficiency Test

An assessment designed to measure an individual's knowledge or competence in a specific area or discipline.

Prediction Interval

A range of values that is likely to contain the value of an unknown parameter for a future observation, with a certain degree of confidence.

Regression Analysis

A statistical technique that analyzes the connection between a dependent variable and one or more independent variables.

Lawn Quality

A measure of the health, appearance, and overall condition of grass-covered ground areas.

Q2: On January 1, 2012, CC Company acquired

Q6: What factor will not affect the estimated

Q44: Simple Inc. had sales of $1,500,000, including:

Q49: Which of the following is an example

Q79: Forest Company paid $38,000,000 for a warehouse

Q81: On January 1, 2011, Forrest Marine Supplies

Q82: The following information was taken from the

Q87: Assume that a purchase invoice for $1,000

Q106: What is meant by "quality of earnings"?

Q141: Describe the single most important characteristic of