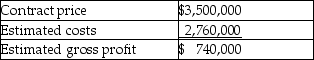

Early in 2012, Forest Ltd. signed a contract to construct a warehouse. Forest's management estimated the gross profit on the contract to be $740,000, as indicated by the following:  At the end of 2012, the status of the work on the contract was as follows:

At the end of 2012, the status of the work on the contract was as follows: How much revenue can be recognized on this contract for 2012, assuming that Forest uses the

How much revenue can be recognized on this contract for 2012, assuming that Forest uses the

Percentage of completion basis for long-term construction contracts (round to nearest dollar) ?

Definitions:

Unnecessary Waste

Refers to materials or resources that are excessively consumed or not utilized efficiently, leading to avoidable loss or expense.

Inventory

Merchandise on hand (not sold) at the end of an accounting period.

Work Around Products

Alternative solutions or products developed to circumvent problems or limitations in existing processes.

Lean Manufacturing

An organized approach for reducing waste in a manufacturing system without compromising on productivity.

Q5: Assume that a purchase invoice for $1,000

Q30: In the chart below, identify the revenue

Q38: Indicate the qualitative characteristic being described in

Q59: Which statement about internal controls over cash

Q62: Which statement is correct about derivative instruments?<br>A)Any

Q93: What is one way to segregate duties

Q98: Which statement is correct about debt instruments?<br>A)A

Q131: The following information was provided from the

Q132: Which statement is correct about a held-for-trading

Q137: Which statement best explains the weighted average