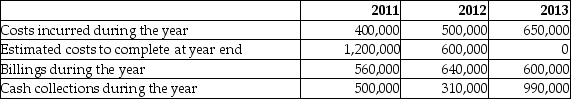

Pool Contractors (PC) entered into a contract to build a solar heated swimming complex for $1,800,000. Construction commenced on July 1, 2011, with a planned completion date of December 31, 2013. A summary of the related accounting information is provided below:  How much gross profit would be recognized in fiscal 2012 if PC uses the percentage of completion method?

How much gross profit would be recognized in fiscal 2012 if PC uses the percentage of completion method?

Definitions:

TV Soap Opera

A serialized television drama focusing on domestic situations and often characterized by melodrama.

Marital Conflict

Disputes or disagreements between married partners, which can range from minor disputes to severe relational disturbances.

Context-Dependent Memory

The improved recall of specific episodes or information when the context present at encoding and retrieval is the same.

Workplace Colleague

An individual with whom one shares a work environment, often collaborating on projects or sharing tasks.

Q10: Explain the accounting implications of the following

Q19: The method of depreciation was changed from

Q43: Use the following chart to explain the

Q48: IFRS identifies a number of criteria to

Q68: Fish Corp. purchases a $100,000 face value

Q84: Sarabjit Inc. produced the following information for

Q88: Garrit Limited's income statement reported the following

Q92: Which question must be considered at the

Q99: Explain what is meant by "channel stuffing"

Q159: Which statement is not correct about expenses