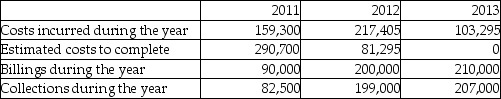

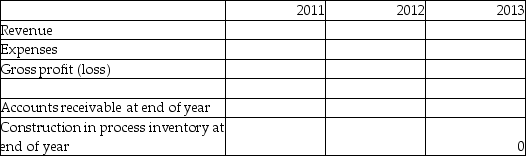

Jones Contractors Inc. agreed to construct a building for $500,000. Construction commenced in 2011 and was completed in 2013.

Required:

Required:

For each of the three years, determine the following amounts relating to the above contract: revenue, expenses, gross profit, accounts receivable balance, and construction-in-process inventory balance.

Definitions:

Supply-Chain Management

The management of the flow of goods and services, involving the movement and storage of raw materials, work-in-process inventory, and finished goods from point of origin to point of consumption.

Consumer Electronics

Electronic equipment intended for everyday use by individuals, including devices like smartphones, televisions, and computers.

Marketing Strategies

Plans designed to achieve marketing objectives, involving the targeted promotion of products or services to specific audiences.

Insourcing

The practice of using a company’s internal employees or other resources to accomplish a task.

Q3: What disclosures are required under IFRS for

Q12: Patient Capitalism is characterized by short-term focus

Q22: List and explain three strategic motives why

Q26: Which statement is not correct about the

Q38: Imports have the potential to lower a

Q43: Identify the two criteria for classifying an

Q61: Using the conceptual frameworks and other ideas,

Q90: For each of the following financial asset

Q94: Thineesha Corp. reported credit sales of $1,000,000

Q154: Assume that a $400 purchase invoice received