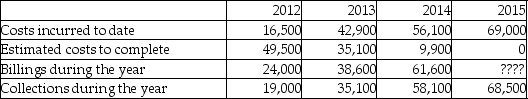

Creation Construction Company (CCC)has contracted to build an office building for Property Corp. The construction started on January 1, 2012, and the project was completed on July 1, 2015. The contract price was $70 million. Due to uncertainties in the construction process, the two parties to the project agreed to a risk-sharing arrangement whereby Property Corp. covers 50% of all cost overruns in excess of the originally estimated cost of $65 million (e.g., if estimated total costs are $69 million, then CCC would receive an additional $2 million for the contract). The following data relate to the construction period.

Required:

Required:

Calculate the estimated gross profit (loss)for 2012, 2013, 2014, and 2015, assuming that the percentage of completion method is used.

Definitions:

Silent Comedian

A performer who specializes in comedy without the use of spoken word, often associated with the silent film era.

Boyish Everyman

A male character archetype that embodies youthful innocence and the relatable, ordinary aspects of everyday life.

Deadpan Facial Expression

A type of facial expression where the face is deliberately impassive or expressionless, often used for comedic effect.

Comedy Partner

A fellow actor, writer, or performer who collaboratively works with another in creating or performing humorous content.

Q1: World War I caused the suspension of

Q11: Which statement is not correct?<br>A)Financial accounting is

Q23: Coral Corporation builds large cruise ships on

Q28: Correction of an error is based on<br>A)new

Q76: Which statement is correct about multiple deliverable

Q78: What is an investing cash cycle?<br>A)A cycle

Q107: Which statement is correct?<br>A)The amount and types

Q109: Investment Company (IC)began operations on January 1,

Q118: Explain the meaning of and give an

Q133: Which method cannot be used in Canada