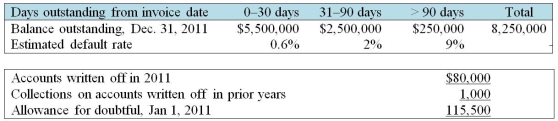

Eastwick Company is preparing its financial statement for the year ended December 31, 2011. A summary of Eastwick's accounts receivable sub-ledger shows the following information:  Required:

Required:

a. Calculate the amount of bad debts expense required for 2011.

b. Present the journal entry to record bad debts expense for 2011.

c. Present the journal entry that was used to record write-offs for 2011.

d. Independent of the information above, suppose Eastwick factored $1,500,000 of receivables without recourse. In exchange, it received $1,380,000. Present the journal entry to record this transfer of receivables.

e. Independent of part (d), Eastwick instead factored the $1,500,000 of receivables with recourse and received $1,430,000 cash. Both Eastwick and the factor anticipate that 2% of these receivables will prove to be uncollectible, so the factor has held this amount to cover any uncollectible accounts. Should the amount of uncollectibles prove to be more or less than 2%, the difference will be paid by/refunded to Eastwick. Present the journal entry to record this transfer of receivables.

Definitions:

Buying Process

The sequence of steps a consumer or organization follows from recognizing a need, through purchase, to post-purchase evaluation.

Environmental Considerations

Assessment of the environmental impacts associated with products or activities and the implementation of measures to reduce negative effects.

Supply Partnership

A long-term relationship between a buyer and a supplier characterized by mutual cooperation, shared risks, and investments to achieve joint value creation.

Mutually Beneficial Objectives

Objectives or goals set in a collaborative context that provide positive outcomes or advantages to all involved parties.

Q11: Micelle Inc. reported credit sales of $600,000

Q14: Discuss two ways in which a bank

Q16: Which of the following is correct about

Q21: Which revenue recognition criterion is not satisfied

Q69: Ontario Ltd. owns a machine that it

Q71: Which statement is not correct?<br>A)Under the successful

Q100: During 2011, Farrah Ltd. purchased 4,000 shares

Q114: Which statement best explains the FIFO cost

Q116: Explain what happens if the value of

Q135: Use the chart provided below to determine