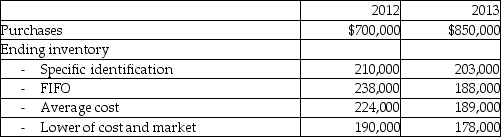

Johnson Ltd. began operations on January l, 2012. Merchandise purchases and four alternative methods of valuing inventory for the first two years of operations are summarized below:

Required:

Required:

a. Which of the four methods listed above does not apply the matching principle? Briefly explain.

b. Determine the cost flow assumption or inventory valuation method that would report the highest net income for 2012.

c. Assuming that FIFO had been used for both years, how much would the cost of goods sold be for 2013?

Definitions:

Debiting

The act of recording an entry on the left side of an account, indicating an increase in assets or expenses or a decrease in liabilities, equity, or revenue.

Alphabetical Order

A method of sorting by arranging items according to the sequence of the letters in the English alphabet.

Accounts Payable

Liabilities or amounts owed by a business to its creditors or suppliers for goods or services that have been received but not yet paid for.

T Account

The simplest form of an account, which consists of an account title, a debit side, and a credit side.

Q7: How is an impairment loss allocated to

Q8: Ronald exchanged similar assets with Silver Company

Q10: Starts has a 60% joint operation interest

Q30: Explain why estimates are necessary in accrual

Q38: On January 1, 2011, Anny Marine Supplies

Q51: A fire destroyed the inventory of Mantis

Q62: Which statement is correct?<br>A)In the exploration phase,

Q96: Identify whether each of the following items

Q98: Soorya Manufacturing makes educational toys that are

Q135: Use the chart provided below to determine